Your credit score is one of the most important numbers in your financial life (probably #2 after your Social Security Number, which is required for just about everything!).

Because credit scores are so important in today’s society, it’s essential to understand your credit score – why it is important, how it is comprised, and how you can improve it.

So let’s take a look at all of these and go from there.

Table of Contents

First, Understand How Your Credit Score Works

Many people believe your credit score only matters if you need to borrow money. That was true once upon a time, but that is no longer the case.

In fact, borrowing money is only one way your credit score can be used.

For example, many people look at credit scores as a mark of how trustworthy people can be with money or high-security items, which is why it is so important to have a good credit score.

For example, many employers use your credit score when screening job applications.

Your security clearance can be affected by your credit score.

Landlords often screen the credit scores of rental applicants before allowing them to sign a lease, and cell phone companies may not provide a line to people with poor credit.

Of course, your credit score is also used by lenders to gauge how likely you are to repay your loan – the higher your score the more likely you are to get a loan at a favorable rate.

How Your Credit Score is Calculated

Because your credit score is so important to your financial well-being, you should try to improve your credit score to receive the best interest rates when you borrow money, improve your chances of getting hired and keep your car insurance premiums as low as possible.

Your credit score is comprised of many different factors from your credit report, each of which has a different weight. The better your credit history, the better your credit score.

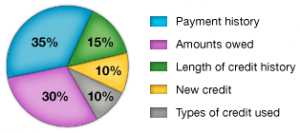

The following chart breaks down the FICO credit score, which is one of the more popular credit scoring models used by lenders.

Most people refer to the FICO credit score when they talk about credit scores. This is the credit score most commonly used by lenders, but there are several different credit scores available. In this example we will examine how a FICO credit score is determined. We can then use this information to understand how to improve your credit score.

Understanding the components of your credit score:

- 35% – Payment history.

- 30% – Amounts owed.

- 15% – Length of credit history.

- 10% – New credit.

- 10% – Types of credit used.

Payment History – 35%

Your payment history is the largest component of your credit score. Lenders want to know your past performance in paying off your loans. Lenders are interested in the type of loan you had, such as a credit card, mortgage, installment loan (a loan with a fixed number of payments, like a car payment), consumer finance account (generally considered a lower-tier type of loan made by companies who generally lend to higher risk individuals), etc. Lenders are particularly interested in these other factors as well:

- The number of accounts fully paid per agreement with the lenders.

- Bankruptcies, judgments, lawsuits, liens, wage garnishments, delinquencies, bills that have gone into collection, or other negative signs that you may be a credit risk.

- How long overdue you were on your payments.

- How much you were past due on your bills or collections.

- How recent these delinquencies or negative marks have occurred.

- The number of past due items on file.

Amounts Owed – 30%

In addition to the types of loans and your payment history, lenders are concerned with how much money you owe. Even if you have a perfect credit record, there is a limit at which lenders will probably not lend you any more money – simply because your debt to income ratio doesn’t support lending any more money to you. These factors are considered for your FICO score:

- Amount owed on all accounts

- Amount owed on specific types of accounts (secured vs. unsecured, etc.)

- Number of accounts with balances

- Proportion of credit lines used (proportion of balances to total credit limits)

- Proportion of installment loan amounts still owed (remaining balance vs. original loan amount)

- Lack of a specific type of balance, in some cases

Length of Credit History – 15%

Lenders prefer lending to people who have consistently shown they can handle credit in the past. Chances are they will be able to handle making payments in the future. Some of the factors that make up your FICO score are:

- Time since all accounts opened

- Time since account opened, by specific type of account

- Time since account activity

New Credit – 10%

New credit refers to how much credit you have taken out recently. Lenders may become concerned if you have recently applied for thousands of dollars in loans and continue to request more lines of credit.

- Number of recently opened accounts, and proportion of accounts that are recently opened, by type of account

- Number of recent credit inquiries

- Time since recent account opening(s), by type of account

- Time since credit inquiry(s)

- Re-establishment of positive credit history following past payment problems

Types of Credit Used – 10%

There are many types of credit on your report. The most common types of credit include credit cards, retail credit accounts, installment loans, and consumer finance accounts.

In addition to the types of credit, your FICO score will also encompass the number of each type of credit, how often they are used, and any recent information for them.

Additional factors affecting your credit scores:

It is important to remember your FICO score takes all of these factors into account, not just some of them. Your credit score will take into account both the positive and the negative information from your credit report. However, it is possible to raise your FICO credit score over time by establishing a good track record.

Note: If you have only recently established credit, your weighting may be slightly different because you have no established credit history.

Lenders look at more than just your FICO score. Your FICO score is only comprised of information found within your credit report. Lenders, however, look at many factors when making a lending decision, including income, current employment situation, type of credit being applied for, and more.

How to Improve Your Credit Score

Credit scores are calculated using a number of factors including your payment history, the amount owed, types of credit you have, and length of time of your credit history.

There are no quick fixes to improving a low credit score, but the following tips will help you raise your score over time.

Payment History

Obviously, the best way to improve or keep a good credit score is to pay all of your bills on time, all the time. Each time you make a payment late or enter it into collections, your FICO score is impacted negatively and the result is a lower score than you’d like.

If you already have accounts that are late, get them paid on time and try to keep them current. The more months in a row you can pay all of your bills on time, the higher your credit score will be.

If you have an account in collections, paying it off will not remove it from your credit report. Collection accounts and bankruptcy data stay on your credit report and impact your credit score for seven years.

Amount of Money You Owe

The rule of thumb is to keep your balances within 30% of your credit limit. If you have credit cards that you owe as much as you’re allowed to borrow, it impacts your score negatively. If you have cards with balances that are almost as much as your credit limit or higher, focus on paying that debt down first.

Don’t close credit card accounts that are paid off or not being used because it reduces the amount of your available credit. When you have less credit available, the amount of debt you have compared to the amount available increases, and lowers your credit score. On the flip side, it’s not a good idea to go out and open a ton of new credit cards to increase your available credit, either.

Length of Credit History

How long you have been managing credit also plays a role in the calculation of your credit score. The more new credit accounts you have, the lower your average account age is, which will affect your score more than if you have several older credit accounts. Opening several new credit accounts in a short period of time will lower your score because it signals you are at higher risk than someone who hasn’t needed to borrow money.

If you need to apply for credit, like for a car loan, apply to multiple places within a few day’s time. The FICO score can distinguish between searching for several different types of credit lines compared to searching for the best rate on a single loan.

Types of Credit

Having a good mix of credit types is ideal, but opening new types of credit just to improve your variety of credit types probably won’t result in a higher credit score. It’s just that someone who has a mortgage, a credit card and a car loan would look less risky than someone who had 4 credit card accounts on their credit report. Having no credit at all is seen as risky when you decide to try and borrow money because the lender has no way of knowing whether you can make your payments on time or not.

How to check your credit score for free

You can monitor your credit score to see if it is improving. The federal government mandates that Credit Bureaus give you a free copy of your credit report once per year, but they do not require them to offer you a free copy of your credit score (see the difference between a credit report and credit score). Here is how to get your Free FICO Credit Score. You may have to sign up for a free trial, which you can cancel before you are charged any money.

Using Credit Cards to Build Credit History and Your Credit Score

My first experience building credit was with a credit card that I opened while I was attending college. Thankfully, I avoided the classic college mistake of maxing out the card in the first month of ownership, then living with debt for the next 10 years. My goal was to apply for the credit card, make several hundred dollar purchases, then pay off the loan over a couple of months to prove I was capable of making regular payments. I paid a few dollars in interest charges over the time I made those payments, but in my opinion, a few dollars in finance charges were well worth building my credit history and credit score.

It has been well over ten years since I opened my first credit card and I haven’t made a finance charge on a credit card since then. That experience and several other successful loans since then have helped me build a high credit score and a favorable credit history.

Will Opening a Credit Card Impact Your Credit Score?

Credit cards aren’t the only way to establish your credit history, but they are usually the easiest way to create a credit history because it is usually easier to open a credit card than other forms of credit such as a car loan or mortgage (lenders are less likely to lend that much money to someone who doesn’t have any credit history).

Once you have established a line of credit, your actions are reported to the credit bureaus which begin recording your credit history on your credit report. Over time, your actions will be used to determine your credit score.

No credit or poor credit? If you are having trouble getting approved for a credit card, then you should check out secured credit cards, which require a deposit and sometimes come with an annual fee. The deposit works as collateral for your charges and if you don’t make on time payments, the bank will use your deposit to pay your charges. Secured credit cards cost a little more than traditional credit cards, but they often come with guaranteed approval and with proper use will help you improve your credit score. After proving your ability to make payments, you can often upgrade your secured credit card to a non-secured card that has a better interest rate and doesn’t come with annual fees.

Important Notes About Building Credit with a Credit Card

Getting a credit card can help you build your credit so long as you treat it responsibly – or else you are only going to hurt your credit score. Credit cards can be a trap for some people, so it’s best to make sure you only make charges you can and will pay in full each month.

Otherwise, you may find yourself getting into a cycle of debt that is difficult to escape from.

Tips to establish your credit and increase your credit score:

- Understand how your credit score works.

- Only charge what you can pay with cash.

- Pay your full credit card bill each month.

- Repeat the process.

- Add time.

Because they are such a big part of your credit history, seemingly small mistakes can add up to make a big impact on your credit score.

Be aware of how your credit score is affected by your credit card habits.

Here are 5 credit card mistakes that seem small at first, but if made too frequently — or made together — can add up to overwhelm your credit score, sending it lower:

1. Paying Late

Your payment history is the most important aspect of your credit score. This means that if you are late in paying, it will be noticed and affect the credit scoring algorithm. Many credit reports list your payment for each credit card every month for the past three years. One or two late payments in that period of time might be overlooked. However, if it appears that a habit is forming, you could find yourself in trouble.

Tip: Always make your credit card payments on time, every time.

2. Maxed Out Credit Card

When you max out your credit card, it looks as though you have money problems. Not only that, but a maxed-out credit card can mean that any sort of fee triggers you to go over your limit — and that comes with its own penalties and credit scoring problems. Try to keep your credit card spending to no more than 25% to 30% of your credit limit. With your credit utilization accounting for the second-biggest chunk of your credit score, this is important.

Tip: Only use a portion of your available credit on each card. You can do this by using more than one card, or increasing your credit limit so normal spending doesn’t bring you close to the card limit.

3. Department Store Credit Cards

The type of credit you carry matters. Major issuers are considered “better” credit card debt than others. This means that the more department store credit cards you have, the worse it looks on your credit report. Don’t apply for these cards just for a discount.

Tip: Limit your credit cards to those from major credit card issuers, banks, and credit unions.

4. A Rash of Credit Card Applications

Applying for a credit card will slightly ding your credit score because it is a hard inquiry. One or two applications probably won’t impact your score too much. However, if you apply for several credit cards all at once, all of those dings start to add up. Combine your rash of credit card applications with a growing balance on your other cards, and applications for department store credit cards, and the red flags begin to weigh on what lenders see as your creditworthiness.

Tip: Limit the number of credit cards you apply for.

5. Closing Credit Card Accounts

At first glance, closing a credit card account or two seems like it’s a good thing — not a mistake.

However, closing your accounts can impact your score.

First of all, it reduces how much credit you have available, which isn’t always a good thing from a creditor standpoint. Second, it reduces the length of your credit history. Your credit history length includes consideration for your oldest account, as well as the average length of all your accounts. If you close a credit account, you affect your average. If you do end up closing a credit card account, pick a newer card to close.

Closing a credit card negatively affects 3 out of the above 5 credit factors as follows:

- Amounts owed are the number of accounts you have with balances and the amounts you owe on them. Your “credit utilization” makes up a majority of this credit variable, which is the ratio of your credit balances to your credit limits. Here’s the problem: When you close a credit card you reduce your credit limit to zero, but the balance you owe remains the same. Having more debt relative to your credit limit dings your score.

- Length of credit history is the amount of time that you have information on a credit report. Canceling a credit card account leaves you with less history to demonstrate creditworthiness, which lowers your score.

- Types of credit is the number and types of accounts you have in your credit report, like credit cards, auto loans, mortgages, home equity lines of credit, and retail accounts. Since having a mix of credit accounts is a boost to your score, canceling all your credit cards reduces your score.

How Much Does Closing a Credit Card Hurt Your Credit Score?

You may wonder how much closing a credit card can hurt your credit score. There is no set amount of points that your score will fall because everyone’s credit situation is different. Since “amounts owed” make up a large percentage (30%) of your credit score, increasing your credit utilization is potentially the worst hazard to closing a credit account.

That means canceling cards with relatively high credit limits can do the most damage—especially if you’ve had them for many years. So be sure to keep at least one major credit card account in good standing to show that you’re responsible with money. Even if you don’t want to use a credit card for regular purchases, it’s a good idea to make small charges and pay off the bill in full each month. That will build your credit and prevent a card issuer from canceling your account due to inactivity.

Tip: Leave your credit card accounts open, but only use them a few times a year to keep the accounts active.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Patricia Wilson says

My husband and I recently sold a home and loan is paid off. We looked at our credit reports before getting approved to start looking for another home. We found that the payment for our home loan had been reported late for 24 consecutive months. It looks like a partial payment was applied to the principal on the loan instead of the payment amount due and through the payment off. I contacted the loan officer and he said the quickest way to get it cleared up was to file a dispute with the credit bureaus. I filed the disputes but over two months now nothing had changed, this got us frustrated and annoyed but we got over this few weeks ago when my nephew (Taylor) informed me about captainspyhacker2 at g mailcom who had helped him out when he had a bad credit, I got in touch with him and we talk. He asked me some few question which I answered correctly, we both got a deal and to my greatest surprise captain helped me fixed my credit every reported payment was removed, late payment was marked on on time payment, all debt was cleared and finally got our score high to 810 respectively. I confirmed this on the three credit bureaus site

Matt Wegner says

The sad part about the credit score is that it has nothing to do with your net worth. It’s based only on debt. You can’t have a credit score without going into debt, and you can’t go into debt without a credit score. You could inherit a million dollars tomorrow and your credit score won’t change one bit. You could pay off your debts and never borrow money again, and your credit score will eventually fade away to zero.

That’s my ultimate goal: a credit score of zero. When I reach that goal, it means I haven’t borrowed for years (I’m on year one of having no debt). To me, being debt free is more important than a good FICO score.