Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Most people face several major expenses in their lifetimes, such as saving for retirement, buying a home, and paying for their children’s college tuition—if they decide to do so. I would like to help my children with their college expenses to the extent I am able.

Thankfully, we have a big head start on helping pay for their college education because I was able to transfer the Post-9/11 GI Bill to my daughters. College tuition is already very expensive and the cost will likely continue to rise in the coming years. So transferring this benefit will be a huge cost savings for us. What follows is my plan to help pay for my children’s college education.

In this article and podcast, I cover the following information:

- Post-9/11 GI Bill Benefits

- Post-9/11 GI Bill transfer eligibility & rules

- Why you should transfer the Post-9/11 GI Bill if eligible (there is no downside!)

- Changes that may soon affect transferred benefits (and how to get grandfathered into the current system)

- Who should use the Post-9/11 GI Bill – you, your spouse, or your children?

- Strategies for getting the most out of the Post-9/11 GI Bill

- Paying for college expenses not covered by the Post-9/11 GI Bill (especially if you have more than one dependent using the Post-9/11 GI Bill)

- and why the 529 College Savings Plan is one of the best ways to save for college

I’m excited to jump in. But before we get started I need to share a small disclaimer. Paying for college can be incredibly complex as there is an almost infinite number of variables. So this is my plan in its current state. My children are more than 10 years out, so there are many unknown variables at play (when they will attend, which school, how much it will cost, available scholarships, etc.).

What follows is some basic information you can use to tailor to your needs. It will be a good idea to sit down and examine your situation in more depth before your children reach college age. And it may be a good idea to sit down with a counselor to learn more about applying for student aid, scholarships, grants, and other methods of paying for college.

The Power of the Post-9/11 GI Bill

The Post-9/11 GI Bill provides 36 months of benefits that cover college tuition up to the maximum in-state college tuition rate, a Monthly Housing Allowance (MHA) equivalent to an E-5 with dependents rate, and a $1,000 annual stipend to help cover the cost of books and supplies. There are also other benefits such as the Yellow Ribbon program that help cover the cost of more expensive private colleges.

Altogether, the Post-9/11 GI Bill, the housing allowance, and other benefits are generous enough to cover college tuition at state schools and many private schools, and it should be enough to provide enough additional income to provide a decent quality of life while attending school.

But it’s only enough to cover college tuition for one person. We’ll look at this in more detail in a moment.

Transfer Your GI Bill Benefits NOW if Eligible

In 2009, the government began allowing military members to transfer their Post-9/11 GI Bill benefits in exchange for extending their service obligation. This was created as a retention tool to keep experienced servicemembers in uniform longer.

There are certain GI Bill transfer eligibility requirements and rules you must meet in order to transfer your benefits to your spouse or children. In short, you must have at least 6 years in service and agree to extend your obligation by a minimum of 4 years. You can only transfer benefits while you are in the military. Because this is a retention tool, you cannot transfer benefits if you have already retired or otherwise separated from the military.

Transferring benefits now ensures your family members won’t miss out on this valuable benefit. So do this now, if you are eligible, and they will be grandfathered into the system. You also don’t have to worry about how much of the benefit you transfer to each beneficiary right now, so long as you transfer at least one month. You can change your benefit allocation at any time. So you have a lot of flexibility when planning how your dependents will use this benefit.

Another reason to transfer benefits now: If you haven’t yet made the transfer, then please read this article on possible changes to transferred GI Bill benefits that may reduce the Monthly Housing Allowance for children to 50% (transferring benefits now will grandfather them into the current system at the 100% MHA rate).

Remember, other than the 4-year service obligation, there is no downside to transferring your benefits. You can always change your allocation at any time. You will still retain the option of using the benefit yourself, or you can give the benefits to your children. Making the transfer gives you options in the future, which is incredibly valuable.

In a moment, I’ll share how I will allocate my transferred benefits and go over a few ways you can look at this to maximize your benefits as well.

Who Should Use Your GI Bill?

Most people automatically assume they should give their GI Bill benefits to their children once they are eligible to use it. There is nothing wrong with this, and this is what I will most likely do. But make sure this is the best use of the benefit. You may find that you or your spouse are better off using the benefit now.

For example, let’s say you are a middle-enlisted member who enlisted for 6 years, then you transferred your Post-9/11 GI Bill benefits when you reenlisted for 4 more years. You decide to leave military service at the 10-year mark. If you weren’t able to use Tuition Assistance Benefits or otherwise complete your degree, it may be in your best interest to use the GI Bill for yourself. Improving your career prospects now will pay dividends for decades to come, and it is much more valuable than giving your children a future benefit.

The same situation applies to military spouses. Frequently moving from location to location can be difficult on a career, but it can be made easier with marketable job skills. If your spouse can attend college now and receive a degree that will help with employment potential, then do it.

Children’s GI Bill Eligibility

The GI Bill lists the following requirements for your children to be able to use your GI Bill (source).

- May start to use the benefit only after the individual making the transfer has completed at least 10 years of service in the armed forces

- May use the benefit while the eligible individual remains in the armed forces or after separation from active duty

- May not use the benefit until he or she has attained a secondary school diploma (or equivalency certificate), or he or she has reached age 18

- Is entitled to the monthly housing allowance stipend even though the eligible individual is on active duty

- Is not subject to the 15-year delimiting date, but may not use the benefit after reaching 26 years of age

Check your VA Home Loan eligibility and get personalized rates. Answer a few questions and we'll connect you with a trusted VA lender to answer any questions you have about the VA loan program.

How Much of Your Children’s College Tuition Should You Pay?

We all want the best for our children, but I’m a big believer in taking care of your own needs before saving for college. Why? Because you (or your children) can always borrow money for college. But you can’t borrow money for retirement.

So when it comes to prioritizing our finances, my wife and I make sure we fully fund our emergency fund, save in our IRA and Thrift Savings Plan accounts, and make sure we have met our long term savings needs. Only then do we put additional funds into a 529 College Savings Plan (I’ll discuss the benefits of a 529 plan later in this article).

How to Allocate Your Transferred Benefits

The Post-9/11 GI Bill is worth 36 months of college education benefits. You can split that among your dependents any way you like once you have made the initial transfer—and you can always go back and change the amount you allocate to each recipient. This flexibility is incredibly valuable, as it gives you a lot of options when it comes time to pay for college. We’ll come back to this in a moment.

In my case, I have kept one month of benefits for myself, I transferred 1 month to my wife, and I transferred the balance (17 months each) to my two daughters.

I used this arrangement to maintain maximum flexibility. This way, my wife and I can decide to go back to school if we want or need to, or we can transfer the bulk of the benefit to our children. It will be more than 10 years before either of our daughters attends college, so there is no rush to make a decision.

How much should you transfer?

It’s a good idea to leave your options open and use the benefits for yourself or your spouse if either of you has the need to further education that won’t be covered by military tuition assistance, MyCAA (military spouse tuition assistance), or other means.

Other than that consideration, I would start with an equal share among all your children. Just divide 36 months of benefits by the number of children you have – so 1 child could receive the entire benefit, 2 children could receive up to 18 months each, 3 children would each receive 12 months of benefits, 4 children would each receive 9 months of benefits, etc. You can always fine-tune the arrangement later.

Paying for the Balance of College Expenses

If neither you or your spouse need the GI Bill and you only have one child, your job is done. Transfer the benefit, and rest easy knowing your child’s college expenses are taken care of. But many people face a more complicated situation.

In my case, I’m looking at both of my children being able to use the Post-9/11 GI Bill to pay for approximately 2 full years of college (assuming I transfer that final month allocated to my wife and me). That will leave two years of college expenses that will need to be paid for.

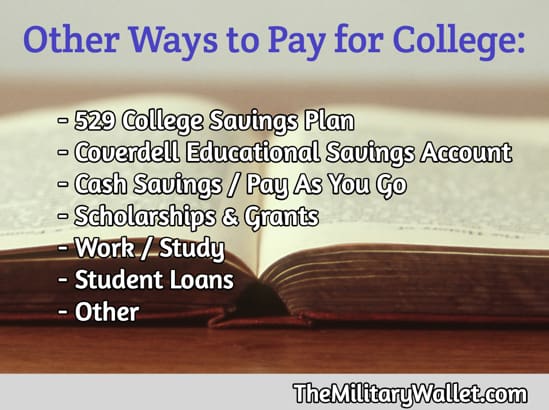

Obviously, the more children you have, the fewer months of benefits they each receive. Which leaves more college to pay for. Here are some common ways to pay for the college tuition the GI Bill won’t cover:

- 529 College Savings Plan

- Coverdell Educational Savings Account

- Cash Savings / Pay As You Go

- Scholarships

- Grants

- Work / Study

- Student Loans

- Other

As you can see, there are many ways to pay for college. And in some cases, you won’t know which will apply to your situation until you get there. Both of my children are more than 10 years out from college, so there are many unknown variables.

A lot can and will happen in those 10 years. We won’t know about scholarships, grants, or work-study programs until around the time college starts. So the best thing we can do at this point is to save for college. We’re going to focus on the 529 plan and cash savings since those are the most widely available and are the accounts we have the most control over.

529 College Savings Plans

I love the 529 College Savings Plan. It’s incredibly flexible, and depending on which state you live in, it can give you tax benefits both now, and in the future.

Here’s how it works:

- You can open a 529 plan for each child you have (the beneficiary).

- Then you can save money in the 529 plan.

- Depending on your state laws, your contributions may be tax-deductible at the state level.

- You can invest the funds in stocks, bonds, mutual funds, CD’s, savings accounts, etc.

- The funds grow tax-free

- Withdrawals of earnings are tax-free if made for Qualified Education Expenses (tuition, fees, books, computers if required by the school, and certain other expenses).

- Withdrawals of earnings are taxable and may be subject to a 10% penalty if made for non-qualified expenses (there are some exceptions for the 10% penalty for students who receive scholarships or attend military academies).

- The IRS has a variety of rules you should read up on for more info.

One more valuable aspect of 529 plans: they can be transferred to family members without taxes or penalties. This is the most flexible way to save for college, since these savings can be transferred to family members without penalty.

Note: there is another college savings plan called the Coverdell Education Savings Account. This plan has its benefits, but it’s not quite as flexible as the 529 plan. Here is an article that compares the 529 plan to the Coverdell ESA.

Cash Savings / Pay As You Go

529 College Savings Plans are valuable for their tax benefits and the ability to transfer them between family members. This is especially important if you have a long time frame to work with as we have in my family.

But 529 plans also lock up your money for college-related expenses. I prefer to maintain flexibility whenever possible. So it may not be a great idea to lock up all your savings in a 529 plan where it can’t be touched without paying taxes and penalties if used for non-qualified educational expenses.

So our plan is to use 529 plans, but also have some savings and investments in taxable accounts (the term used for accounts that have no special tax treatments, like the tax benefits found in retirement accounts, 529 plans, Coverdell accounts, etc.).

Having cash in savings and other investments is more flexible than relying solely upon a 529 plan, as the funds can be used for other needs if they arise. (Financial emergencies, job loss, relocating, early retirement, child receives a full scholarship, child doesn’t attend college, etc.). You do pay taxes on all the earnings in your taxable accounts, but the flexibility may be worth it for many people.

Other Ways to Reduce College Tuition

We’re still a long ways out from college, so we have many unknown variables to work with. Hopefully, our children will make things easy on us by receiving some form of scholarship, financial aid, grants, or have some of their own savings to contribute. There are also work-study programs and other ways to reduce the cost of tuition. Or, like me, they may decide to join the military and receive tuition assistance benefits to help pay for college while they are serving (or earn a future version of the GI Bill).

Another way to reduce college expenses is to attend a less-expensive community college for two years to earn the basic college requirements, then transfer to a traditional four-year university. Doing this makes it easier to pay for community college using college savings, paying cash as you go, or if you live in Tennessee, not paying tuition at all. The bonus is most community college students will be able to continue living at home, saving a lot of money on room and board. Then you can save the GI Bill for the more expensive tuition and room and board at the university.

Some students are even choosing international colleges where they can receive tuition that is more or less free, leaving them on the hook for room and board, and travel. This can be much less expensive than a traditional four-year university in the United States.

Flexibility is Key

I wish I could hand you a blueprint and tell you, “this is exactly what you need to do to help your children pay for college.” But I have already recorded a 30-minute podcast and have written over 2,500 words here and I’ve barely scratched the surface.

The more likely scenario is that your situation will be completely unique. This should serve as a rough guide to get some ideas flowing. But your situation depends on whether you have transferred the benefit, how many children you have, how long you have to save, how much you are able to save, the school they attend, available scholarships and grants, the total cost of tuition, room and board, and many other factors.

There is a book in here for someone who wants to tackle this topic. And there are dozens of websites and businesses that help people understand their options and make these decisions. The big takeaway is that you have options and you have time. Use them to your advantage, and above all, remain flexible.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Mariano Rodriguez says

Is there anyway I can transfer My G.I. Bill to my son I did not know that I had to be an active or not separated from the military to transfer bills I’ve been out since November and it’s March now?

Ryan Guina says

Hello Mariano,

There is no way to transfer the GI Bill to a family member once you have left military service. The transfer is a retention tool and requires the servicemember to serve an additional 4 years of military service.

The only way to transfer the GI Bill would be to sign up for the military again, transfer the benefit, and incur an additional 4-year service commitment.

I wish you the best, and thank you for your service.