Here’s an understatement: The U.S. tax code is complicated.

While I don’t have any problem paying my share of taxes, I do have a problem with the complexity of our tax system.

Federal estimates put the collective time spent on complying with tax laws at 6.08 billion hours in 2020. That is a lot of time to do taxes.

Many of hours were from business tax returns, but personal taxes have become increasingly difficult to navigate.

Our personal situations may further complicate doing tax returns, whether that is being in the military, owning a small business, working as a contractor or freelance worker, having large or complicated investment portfolios, etc.

Thankfully, most tax software programs are powerful enough to do the heavy lifting. Still, the responsibility falls on us, as individuals, to ensure our tax returns are done properly.

I’m not a tax expert, but as a small business owner and member of the Illinois Air National Guard, I have a fairly complicated tax situation.

I’ll share my system to give you ideas to better manage your taxes. Hopefully, you can figure out ways to save a lot of time and aggravation when you file your taxes.

How I Organize My Tax Documents

Everyone has a different tax situation. What works for me may not work for you. Consider this a starting point, and modify it to suit your needs.

My situation: I am a small-business owner and member of the Air National Guard. I also receive W-2 income through my business (meaning I pay myself a salary). I file two tax returns every year: A personal return and a business return.

Organizing Tax Documents

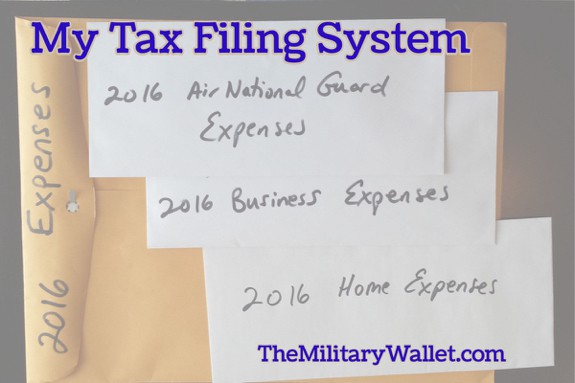

In organizing my tax files, I start by using a large manila envelope and writing the tax year on the outside. As the year progresses, I place every document in it that may be tax-deductible. That includes charitable contributions, business receipts and expenses, child care, tax forms, copies of individual retirement account (IRA) contributions, etc.

Anything and everything that may be tax-deductible goes into this folder.

I also keep three regular-size envelopes inside the manila folder for:

- Business receipts

- Receipts related to my home office and other related home expenses

- Receipts related to my Air National Guard expenses

Since I live more than 100 miles from my base, I can deduct mileage, lodging and a portion of my meal expenses. I track mileage for my business and for the National Guard on separate tabs in a spreadsheet. I deduct business mileage for my business and Guard mileage on my personal tax return.

Business and Personal Records Shouldn’t Mix

I keep business and personal expenses separate, as required by the IRS. While the receipts all go into the same envelope, I separate them in individual envelopes.

You can do this with one folder or multiple folders. Just be sure to keep everything in one place so you don’t have to search when tax season rolls around.

My business income and expenses are tracked with Intuit QuickBooks, which is a home and business accounting software platform. There are different options, but I started with QuickBooks years ago and haven’t found the need to change. Depending on your situation, you may be able to track your expenses with a spreadsheet or a different software platform.

Digital Filing System for Tax Documents

I scan copies of all my tax paperwork because the IRS accepts scanned copies of tax-related papers. This becomes important if you are ever audited. I maintain both digital and paper copies of my documents.

Paper forms are easier for me to physically see what applies during the year, and I give copies of the required documents to my accountant.

The digital files go into a filing system organized by tax year. I keep these files synchronized between my computers with DropBox, a cloud storage platform that is free for basic users, with more premium versions for a fee. I also maintain backups on a hard drive just in case.

Here are the naming conventions I use to keep track of things:

- TaxYear_IRS_Form_Number_Description

- Example: 2020_1098_Mortgage_Interest.pdf

- Example: 2020_1099_INT_Insert_Bank_Name.pdf

- Example: 2020_W_2_Ryan_Business.pdf

- Example: 2020_W_2_Ryan_ANG.pdf

I maintain digital copies of my business and Air National Guard expenses in folders as well, so I have backup copies if those documents are needed for an audit or other reasons. While my naming approach for those is similar, I use a slightly different format that includes the date and a brief description.

Here are two examples (the first for business and the second for my Guard expenses):

- Business Expense Naming Convention: Expense_YYYY_MM_DD_Nature_of_Expense.pdf

- Business Expense Example: Expense_2021_04_20_Accountant_Business_Tax_Return.pdf

- Guard Expense Naming Convention: Expense_ANG_YYYY_MM_DD_Nature_of_Expense.pdf

- Guard Expense Example: Expense_ANG_2021_04_20_Restaurant_Name.pdf

Use a Checklist for Your Tax Situation

Every military veteran is familiar with standard operating procedures (SOPs).

SOPs are one way to document a process so you can repeat it, saving time and energy, improving consistency and removing the guesswork from complicated tasks.

That’s why I created my own SOPs for my taxes.

I created my checklist in Microsoft Excel, giving me a spreadsheet to copy and paste each year into my tax folder.

In Excel, I have different tabs for my personal, business and Guard info. Those include mileage and meal costs, since those are tax-deductible because I live more than 100 miles from my Guard unit.

On my personal tab, I list items such as:

- Bank 1099 forms for interest and dividends

- W-2 forms from my business and the military

- Tax deductions for charitable contributions

- 1098 form for mortgage interest paid

- 1095-B proof of health care

I have a check box by each item and a column for notes. I check off each item as I add it to my tax folder, either my digital folder or my manila envelope

I update the spreadsheet as needed when my situation changes, such as opening a new account, needing a new form, old forms that are no longer needed, etc.

Using spreadsheets allows me to see how my situation changes each year, and it helps avoid missing necessary forms or information.

I use a similar process for tracking my deductions for serving in the Guard as well as tracking business forms.

Once I have all the items checked off on my checklist, I know I’m ready to forward everything to my accountant. We both prefer that I send everything at once because it makes tax prep and processing easier.

Other Methods for Organizing Tax Papers

The system I use works for me, but everyone must find an approach that works for them.

For example, many people put all their files into a large folder or shoe box and sort through them when tax season rolls around.

I prefer the work-as-you-go model, as I find it saves me time.

Others are all digital, which can be a time-saver, provided you use a robust online platform or maintain backups of your files. Examples include scanning documents and maintaining an online backup or using Dropbox, Microsoft OneDrive, Google Workspace or a similar online storage platform. You can also attach receipts to expenses in software accounting platforms like QuickBooks or QuickBooks Online.

Shoeboxed is another company with a cloud storage solution for tax documents and small businesses. For small business owners, freelancers, contractors and those in similar lines of work, it’s a powerful tool that can scan your documents right into QuickBooks.

Which Tax Documents Should You Keep?

Everyone has a different situation when it comes to deciding what paperwork is necessary in filing taxes. I err on the side of caution and keep everything I might need.

After a couple of years, you’ll get an idea of which documents you need and which you don’t. Then you don’t have to worry about missing or losing anything of importance when everything is in the same physical or digital location.

At minimum, I keep everything related to business income or expenses, all tax-related documents, including IRS correspondence and tax returns, and anything else that may apply. If I have questions, I ask my accountant when I do my taxes.

Other common documents everyone should keep include:

- Charitable contributions

- All tax forms and IRS correspondence, such as W-2s, Form 1095 (proof of health insurance), 1099s, 1098s, 5498 (IRA contributions), Health Savings Account (HSA) contributions, etc.

- Taxes paid, including property, motor vehicle, etc.

- Mortgage interest paid

- Qualified business expenses

- Receipts for qualified deductions

- Purchase or sale of investments

The list of deductible items is extensive, and I can’t list them all here. These links list more examples:

- Itemized deductions (IRS)

- Tax credits and deductions (IRS)

- Examples of expenses you can and cannot deduct (James Maertin, CPA)

The good news is that most tax software, such as TurboTax and H&R Block online, walks you through questions that are designed to help identify which tax deductions you are eligible for. If you do your own taxes, it’s generally best to use a software program to help avoid omission errors of omission.

If you don’t prepare your own taxes, then a good accountant can help identify tax deductions. My accountant sends me a questionnaire to help identify the deductions I am eligible for. The questionnaire includes queries about homeownership, investments, employment, child care and more (and is about 10 pages long).

How Long Should You Keep Documents?

Most sources recommend keeping your tax papers for the last seven years, which is generally how far the IRS may go if you are audited. The IRS may be able to go further back if fraud is alleged or suspected.

I keep everything, since most of it is scanned in digital format, and digital storage is inexpensive. I also keep the physical documents in banker’s boxes, organized by tax year.

I have the large manila envelope from each year containing the documents listed above, and I keep another manila envelope with my completed tax return.

My current records only go back about a decade, when my wife and I got married. This was also before I started my business.

Since I’m a small business owner, I plan to keep all related tax returns as long as I own the business.

There Is No One-Size-Fits-All Solution

Every situation is different. Hopefully, yours is less complicated than mine.

My hope is this points you in the right direction to get your tax documents organized. When in doubt, save the papers because it’s better to have documents and not need them later than to need them and not have them.

Also, keep everything in one place. Use a manila envelope, a shoe box, a folder or other means of storing your documents and paperwork. It makes your life much easier when tax time rolls around.

Comments:

About the comments on this site:

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Delphia Clark says

I would like to get the new IRSform w-4p .withholding for my annuitant account